Why Is Money Laundering Hard To Detect

The rise of online banking institutions anonymous online payment. As such business has no variable costs it is hard to detect revenues-costs discrepancies.

A Guide To Offshore Banking Swiss Bank Offshore Bank Offshore

Examples are parking buildings strip clubs tanning beds or casinos.

Why is money laundering hard to detect. Money laundering is getting harder to detect and trace due to the changing technology and integration of economies among markets. Money laundering is hard to define because it is not a crime like murder robbery or rape where the evil act is clear. When one is dealing with large sums of illicit money one launders it by first washing it in detergent and water then sending it through the dryer preferably with a couple of heavy items wrapped in towels.

Under increasing regulatory pressures to change this banks hastily repurposed these systems into other areas of the business. As a result criminals are turning to professional services firms for help whether the firm knows it or not. Because these activities violate card network rules not only are applicants rejected upon applying for merchant accounts but their.

Meaning the person laundering the money had to have known about the criminal activity that generated the funds at the beginning of money laundering. It is important for us to understand the origin of the source of funds by having a swift reliable identification verification system to stop offenders in the beginning stages of money laundering. If you hesitate while trying to come up with a definition you have begun to understand part of the problem.

Under- or over-valuing invoices to disguise the movement of money. 10 Who do banks report money laundering to. In short money laundering aims to disguise money made illegally by working it into a legitimate financial system such as a bank Top Banks in the USA According to the US Federal Deposit Insurance Corporation there were 6799 FDIC-insured commercial banks.

Investigators often start with one or more bread crumbs and then follow the money trail through a series of structured transactions involving small deposits cash and equivalents. As such most global money laundering is. Best suited is a service business.

Unnecessarily complex group structures and investments in areas with no obvious geographical connection can both be indications of money laundering the CCAB says. Shipping paperwork may be consistent with both sales contracts and with the goods actually shipped so the illegitimate funds are obscured unless investigators appreciate the true market value of the goods. When it comes to laundering money the deception or corruption of trusted.

Unlike fraud money laundering stems from a precursor criminal act like extortion misappropriation of funds or trafficking. In fact two different people can engage in the exact same set of activities and one can be guilty of money laundering while the. Similar to money laundering criminals need a way to disguise incomes acquired from prohibited ecommerce businesses eg illegal online gambling or child pornography and integrate it into the legitimate financial system.

Inevitably these have not been suited to the product line that they are trying to protect with systems struggling to. With hard-to-value goods such as fashionable clothes or used cars detection. This actually does happen or it did.

Money laundering is hard to detect because of the sophisticated layering techniques used to mask parties and layered transactions. At first financial institutions put systems in place to detect money laundering within their retail book with other product lines left unprotected. The lack of regulatory focus and effective disincentives on the Trade-based Money Laundering crimes is one of the reasons why money launderers find it.

After being laundered it becomes difficult to distinguish money from legitimate financial resources and the funds can be used by criminals without detection. It is a crime of motive rather than activity. When it comes to preventing.

9 Why is money laundering hard to detect. Do you actually wash money in money laundering. Before proceeds of crime are laundered it is problematic for criminals to use the illicit money because they cannot explain where it came from and it is easier to trace it back to the crime.

Murray identified that in the US even when there is a seemingly obvious case for money laundering prosecution it is difficult. That is why it is also the most effective sector when it comes to detecting signs of money laundering. Money laundering is the process of disguising the proceeds of crime and integrating it into the legitimate financial system.

Similar to Scotland the US uses predicate offense where the accused money launderer had to be privy to the criminal status of the funds prior to the interactions involving the money to be laundered. There is no avoiding the fact that TBML is challenging to detect. The transactions move the funds through layers of agents companies and financial.

Why is Transaction Laundering used. The financial system is the economys circulatory system and all payments flow through it. The use of the Internet allows money launderers to easily avoid detection.

And that is why he noted anti-money laundering is a pivotal intrinsic element of the financial activity and one of the key responsibilities of banking institutions. The deceptions involved are often very subtle.

Podcast How Banks Detect Money Laundering

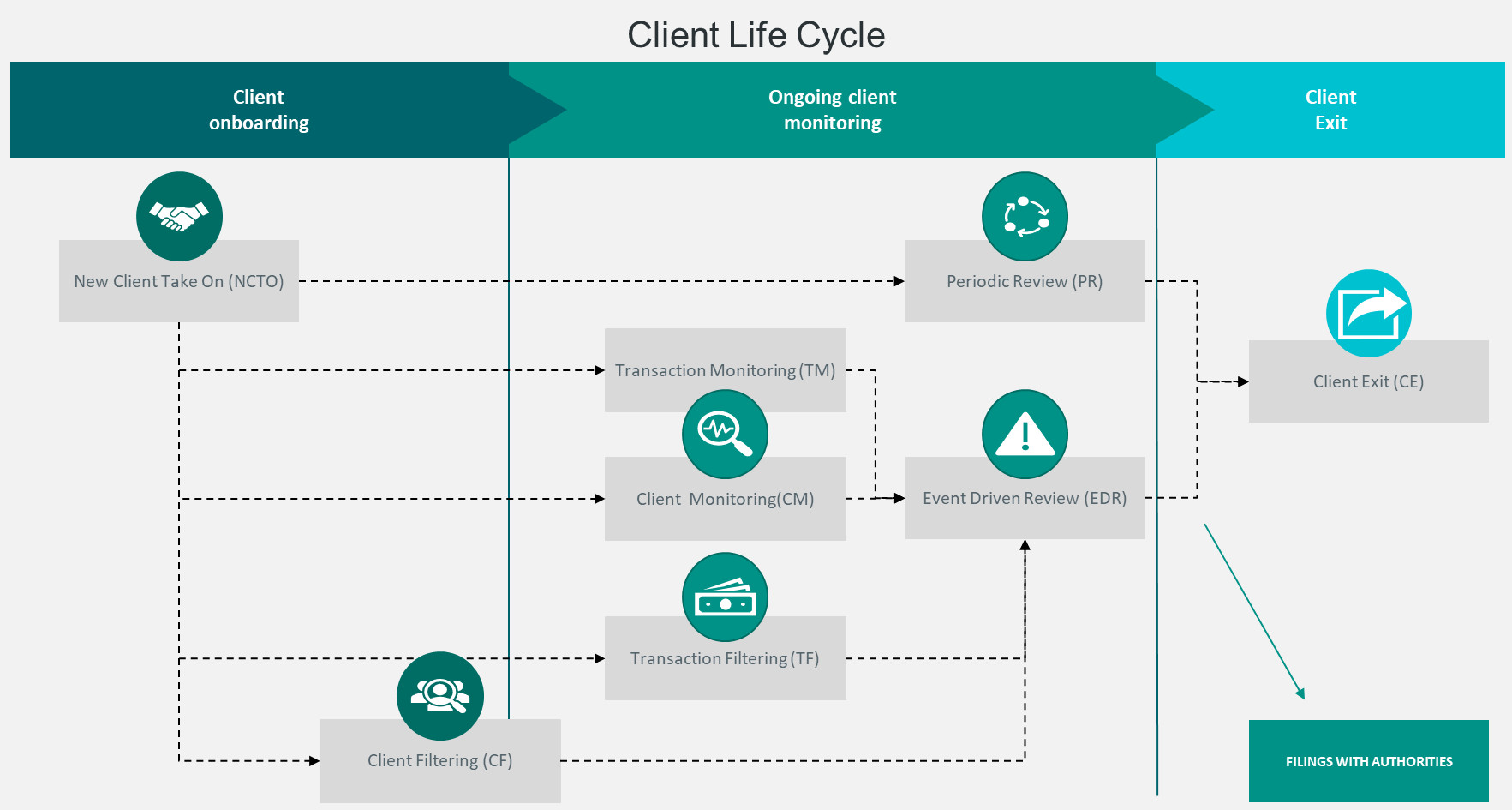

Trade Based Money Laundering Challenges Detection And Prevention

Pin By Ahmad Fajar On Data Mining Data Mining Fraud Downloading Data

How Banks Use Ai To Catch Criminals And Detect Bias By Abn Amro Abn Amro Developer Blog Medium

Aws Builders Day Fraud Detection With Sagemaker Solution Architect Data Science Day

Https Essay Utwente Nl 79963 7 Karia Ba Bms Pdf

Https Hal Archives Ouvertes Fr Hal 02884824v3 Document

Ai Vs Money Laundering Who Wins Bobsguide

How To Recognize Human Trafficking In Transaction Monitoring Enterprise Risk Management Software Businessforensics

Mpc As A Fraud Detection And Anti Money Laundering Aml Tool Tno

Podcast How Banks Detect Money Laundering

Idenfy Identity Verification Services To Help Companies Detect And Prevent Fraud Startup Stories Parenting Organization Identity

Consensys Is Shutting Down Offices In India And The Philippines Joseph Lubin Philippines Bitcoin Company

Gatekeeper Of The Financial System Abn Amro Bank

Forensic Accounting Image Url Https Media Licdn Com Mpr Mpr Shrinknp 800 800 Aaeaaqaaaaaaaamtaaaajguznduzown Learn Accounting Accounting Forensic Accounting

Ai Vs Money Laundering Who Wins Bobsguide

5 Methods That Modern Money Launderers Use To Beat Detection Tookitaki Tookitaki

Money Laundering How Do Banks Detect Criminal Activity N26

How To Detect Commonly Used Trade Based Money Laundering Tbml Techniques

Post a Comment for "Why Is Money Laundering Hard To Detect"