Types Of Money Laundering Activities

Money obtained from illegal activities is. 1956 defines three specific types of criminal money laundering according to the DOJ.

It is important to understand some widely used money laundering methods so that.

Types of money laundering activities. Examples of money laundering 1. Most of the times the deposits are made into offshore accounts or in companies which promise upheld secrecy. 1 Know Your Customer KYC- this includes extensive background checks verifying customer information providing customers with fraud protection and monitoring transactions.

And undercover sting money laundering transactions 1956a3. They include bank methods smurfing or structuring currency exchanges and double-invoicing. If they do not do so that illegal money can link them to criminal activity.

If your business is registered for money laundering supervision. Money laundering is a means of storing or transporting money while obscuring its true origin. This involves directly smuggling cash and storing it into on banks in other countries.

If you want to know real life stages of money laundering and the most frequent schemes and cases of money laundering in. Anyone in your business must report any suspicious transaction or activity they become aware of to the nominated officer. Existing anti-money laundering laws AML are slow to catch up to these types of cybercrimes since most AML laws attempt to uncover dirty money as it.

Thats an absolute world record. International money laundering transactions 1956a2. Offshore accounts are the account which is located on different regions of the depositors residence.

They pretend service sales justifying the difficulty of quantification with this they argue the refund of foreign currency that once legalized to the local currency is distributed to natural persons incurring money laundering. In fact the origin of the term money laundering comes from infamous gangster Al Capones practice of using a chain of laundromats he owned to launder huge amounts of cash. Similar to embezzlement trade-based laundering typically involves altering invoices or business documents in order to disguise dirty money as business profits.

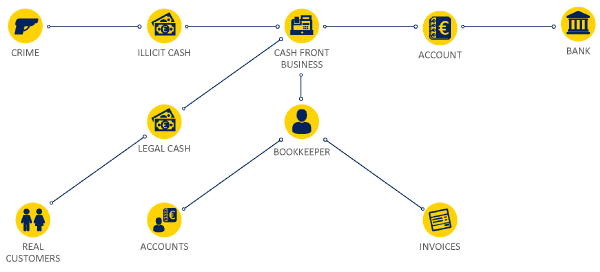

Instead of creating a shell company an alternative for money laundering may be to invest in a legitimate business such as a casino or bar. Domestic money laundering transactions 1956a1. Creating a huge amount of money from criminal activities such as terrorist activity drug trafficking started from a legitimate source is known as money laundering.

Domestic money laundering transactions 1956a2. Examples may include mechanics landscapers or hairstylists. Are associated with only one of the three phases of money laundering while others are usable in any of the phases of placement layering and integration.

A number of others that may be of importance are listed in. Because the money has a paper trail the bank does not suspect the profits as dirty However if your business documents show an unexplainable substantial profit increase the bank may see it as a red. This has also been partially fueled.

Obligors from both financial and non-financial sector are registered in. Four methods of money launderingcash smuggling casinos and other gambling venues insurance policies and securitiesare described below in some detail. Types of Suspicious Activities or Transactions Money Laundering using cash transactions unusually large cash deposits made by an individual or company whose ostensible business activities would normally be generated by cheques and other instruments.

The Law shall implement measures to detect and prevent money laundering and financing of terrorist activities. These money laundering methods can broadly be categorised into a few types. There are numerous different techniques that are utilized by money laundering agents in order to portray the money earned as legitimate.

Section 1956a defines three types of criminal conduct. International money laundering transactions. The money laundering process usually goes something like the following.

The criminals try to cover the origin of that money obtained illegally so that it can look legal. Anti-Money Laundering AML can be divided into three main categories. According to this official report each single day 11 examples of money laundering methods have been reported.

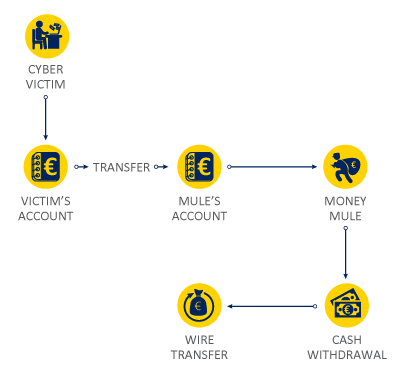

Increasing digitalization and new online payment and entertainment options have created new avenues for money launderers. Obligors stipulated by the Law on the Prevention of Money Laundering and Financing of Terrorist Activities hereinafter. Are all this 5300 Million Swiss Francs the criminal proceeds deriving from money laundering activities.

Bulk cash smuggling. A criminal or criminal organization owns a legitimate restaurant business.

Money Laundering Crime Areas Europol

Money Laundering Define Motive Methods Danger Magnitude Control

Tanzania Financial Intelligence Unit Money Laundering Definition Kitengo Cha Kudhibiti Fedha Haramu Maana Ya Biashara Ya Fedha Haramu

What Are The Three Stages Of Money Laundering

Financial Action Task Force On Money Laundering Fatf Fincen Gov

What Is Money Laundering Three Methods Or Stages In Money Laundering

Guide To Money Laundering In The Year 2021 Regtechtimes

How Money Laundering Works Howstuffworks

How Money Laundering Works Howstuffworks

Money Laundering Ring Around The White Collar

Understanding Money Laundering European Institute Of Management And Finance

Money Laundering Overview How It Works Example

Cryptocurrency Money Laundering Explained Bitquery

Money Laundering Terrorist Financing Are You Aware Anti Money Laundering Compliance Unit

What Is Money Laundering Three Methods Or Stages In Money Laundering

Prevention Of Money Laundering Gov Si

Money Laundering Crime Areas Europol

3 Stages Of Money Laundering Techniques Anti Money Laundering

Post a Comment for "Types Of Money Laundering Activities"