Money Laundering Regulations 2017 Estate Agents

A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. The application of the Anti-money laundering regulations will not be extended to include lettings activity.

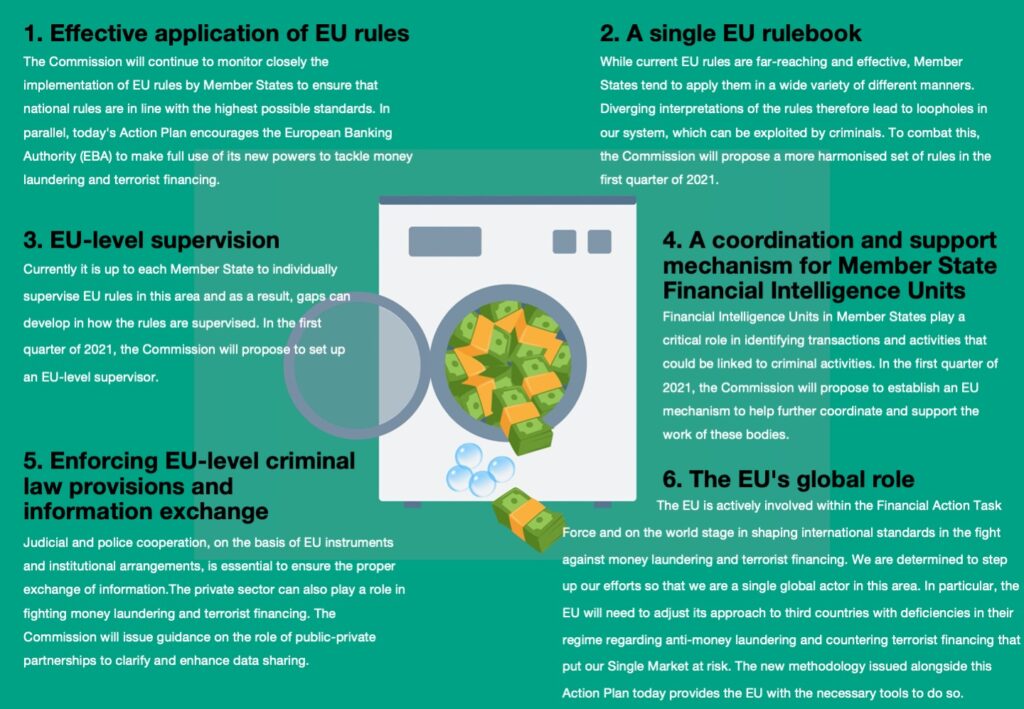

When One Door Shuts Another One Opens The Commission S New Aml Action Plan Planet Compliance

The new advice spells out the policies controls and procedures that agents must put in place and says agents must devote enough resources to deal with money laundering and terrorist financing.

Money laundering regulations 2017 estate agents. However if letting agents carry out estate agency work in accordance with the Estate Agents Act 1979 they have to register. Additionally we are also required to establish whether there are any beneficial owners on whose behalf the transaction or activity is taking place hence we would request. Anti-money laundering regulations 2017.

This update is for real estate agents lawyers and conveyancers and other sectors involved in property transactions who are reporting entities for the purposes of the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 the Act. NAEA added several new Financial Crime Update courses to help estate agents understand recent changes to Anti-money laundering regulations. Additionally we are also required to establish whether.

This means that we have to obtain and hold identification and proof of address for all customers. Under MLR 2017 estate agents are to be treated as entering into a business. In September 2016 the Government launched a consultation entitled Transposition of the Fourth Money Laundering Directive.

August 11 2021 The concept of cash laundering is essential to be understood for those working in the financial sector. It outlined how the Government intended to implement the EUs 4th Money Laundering Directive and the Fund Transfer Regulation which accompanies it. A sub-agent providing estate agency services to a main estate agency business.

You can see a list of businesses not complying with the Money Laundering Regulations 2017. As with all Estate Agents Foxtons is subject to the Money Laundering Regulations 2017. The 2017 MLRs have been informed by the responses submitted and.

Anti Money Laundering Regulations 2017 Estate Agents Get link. New anti-money laundering regulations for agents February 5 2020 Categories. Regularly provide training in how to recognise and deal with transactions and other activities which may be related to money laundering or terrorist financing.

Estate Agents and the new Money Laundering Regulations Registration with HMRC. Estate agents and companies that carry out property sales have been required to comply with the Money. This means that we have to obtain and hold identification and proof of address for all customers.

Business Relationships Regulation 4. Money Laundering Regulations 2017. The section on politically exposed persons has been update in the estate agency business guidance for money laundering supervision.

Proving your identity and ownership of a property. Money Laundering Regulations 2017 By painsmith 23rd May 2017 On 26th June 2017 the Fourth Anti-Money Laundering Directive 4MLD will come into effect. The estate agents visited were in London 35 Leicester 5.

A copy of the anti-money laundering policy. Money laundering regulations 2017 estate agents. Guidance updated to explain who must register for money laundering supervision.

26 June 2017 This guidance has been updated to. Under the MLR 2017 estate agents must register with their supervisory authority which is. The Directive replaces the Third Anti-Money Laundering Directive which was implemented in the UK by way of the Money Laundering Regulations 2007.

Make employees aware of the law relating to money laundering and terrorist financing. Its a course of by which dirty cash is converted into clear cash. New money laundering regulations come into effect on 10 January 2020 bringing certain letting agents dealing with residential andor commercial property within the scope of money laundering legislation.

20073298 with updated provisions that implement in part the Fourth Money Laundering Directive 2015849EU fourth money laundering directive of the European Parliament. Regulation 24 of the Money Laundering Regulations 2017 requires estate agencies to. Agents that take deposits including auctioneers do handle money.

Combatting Money Laundering And Terrorist Financing Government Se

Anti Money Laundering What It Is And Why It Matters Sas

Pdf Evaluating The Control Of Money Laundering And Its Underlying Offences The Search For Meaningful Data

Fatf Issues First Ever Report On Environmental Crime And Money Laundering Money Laundering Watch

Anti Money Laundering What Is Aml Compliance And Why Is It Important

New Money Laundering Regulations For Uk Will Trusts Wills Worldwide

Anti Money Laundering What Is Aml Compliance And Why Is It Important

Anti Money Laundering 2021 Laws And Regulations Usa Iclg

![]()

Money Laundering Fighting A Global Problem From Home

Papua New Guinea Anti Money Laundering And Combating The Financing Of Terrorism Mutual Evaluation Report

What Is Anti Money Laundering Quora

Anti Money Laundering Ultimate Guide Training Express

Aml Screening How It Might Infiltrate Your Business

Whales Sharks And Flounders Conceptualizing Real World Money Laundering Cfcs Association Of Certified Financial Crime Specialists

The Intersection Of Money Laundering And Real Estate Money Laundering Watch

Art And Antiquities Conduits For Money Laundering And Terrorist Financing Acams Today

Brief Summary Of The Money Laundering Regulations 2017

The Definitive Guide To Anti Money Laundering Countering Of Terrorist Financing

Post a Comment for "Money Laundering Regulations 2017 Estate Agents"