Kyc Anti Money Laundering Law

Anti-money laundering and countering the financing of terrorism AMLCFT technology risk assessments sanctions compliance and more in-d epth information about how US. Steptoe provides legal advice on all aspects of anti-money laundering AML rules and regulations.

Difference Between Kyc And Aml Tookitaki Tookitaki

KYC requirements for businesses and financial institutions.

Kyc anti money laundering law. Currency the conflict between federal and state laws affecting marijuana-related businesses the selection and use of US. They also apply to other firms undertaking certain financial activities see Schedule 2 of the regulations. Satisfy yourself that the source of the customers funds is legitimate.

The anti-money laundering law Federal Law No. This section outlines the anti-money laundering AML roles responsibilities and appointment of senior individuals in a practice including the money laundering reporting officer MLRO money laundering compliance officer MLCO and beneficial owners officers and managers BOOMs as well as some of the structures that practices must or should put in place eg. Vincent and the Grenadines laws.

Why KYC is Important in the Legal. Billing and clearing are governed by the St. AMLCFT standards compare to those issued.

The Member States had to transpose this Directive by 10 January 2020. The Company has policies in place to deter people from laundering money. In todays financial landscape banks must adhere to strict regulations associated with Know Your Customer KYC and Anti-Money Laundering AML laws.

Ensuring clients have valid proof of identification. With regulations increasing in the legal sector anti money laundering AML requirements are only going to become more important. Anti-money laundering requirements on financial institutions and other businesses are established by Law 102010.

At Sentinel we provide high-quality KYC services to protect our clients including law firms from money laundering and other fraudulent activities. Most of all these procedures are critical functions to access and monitor customer risk and legal requirement to also comply with Anti-money laundering AML laws. The Borrower on behalf of itself and each.

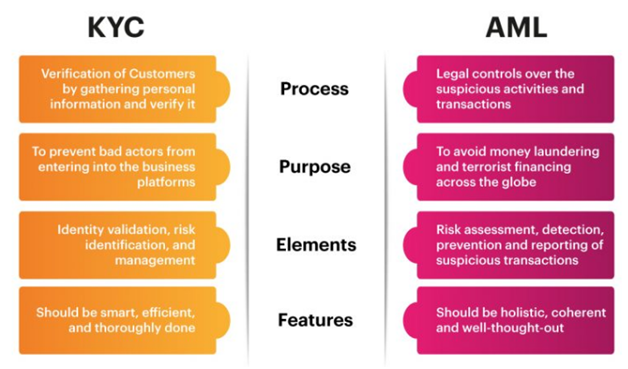

Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. The fines for non-compliance with AML Know Your Customer KYC and sanctions requirements continue to be large the costs of compliance continue to increase and firms are increasingly under pressure to identify ways to manage their AML risks more effectively both from a regulatory and commercial standpoint. 115-FZ On Combating Money Laundering and the Financing of Terrorism the AML Law came into force on 1 February 2002 and has been revised a number of times to reflect the global developments in this area.

This Law is developed by Regulation of the Law 102010 of 28 April on the prevention of money laundering and terrorist financing approved by the Council of Ministers. Oversight and that Anti Money Laundering AML regulatory requirements are being adhered to at both a local and global level. In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to.

Effective KYC involves knowing a customers identity their financial activities and the risk they pose. To help the US. Government fight the funding of terrorism and money laundering activities Federal law requires all financial institutions to obtain verify and record information that identifies each Person who opens an account including applicable Know Your Customer requirements.

Victoria Coins does not tolerate money laundering and supports the fight against money launderers. With its deep bench of US- UK- EU- and Hong Kong-based lawyers Steptoe helps companies navigate this complex and overlapping legal and regulatory AML landscape from the implementation of robust compliance measures to robust responses to red flags or to regulators. Assess money laundering risk.

KYC or performing customer due diligence CDD should be performed regardless if AML regulations exist. On 19 June 2018 the 5 th anti-money laundering Directive Directive EU 2018843 which amended the 4 th anti-money laundering Directive was published in the Official Journal of the European Union. Since the financial crisis in 2008 banks and financial institutions have been bombarded relentlessly with financial regulations intended to safeguard financial systems and customers as well as increase transparency.

5 th anti-money laundering Directive. Financial Crime Guide Tool. Anti-Money Laundering AML compliance is a regulatory requirement that applies to banks building societies and credit unions.

What Is Aml Kyc In Crypto Sygna

Best Explained Know Your Customer Kyc Anti Money Laundering Aml Study Capsule Youtube

Anti Money Laundering Overview Process And History

What Is Kyc Know Your Customer And Aml Anti Money Laundering Mobbeel

Difference Between Kyc And Aml Tookitaki Tookitaki

What Is Know Your Customer Kyc Anti Money Laundering Aml Master The Crypto

Kyc Know Your Customer And Aml Anti Money Laundering By Goldma Team Medium

Industrial Significance Of Kyc Aml Compliance In 2019

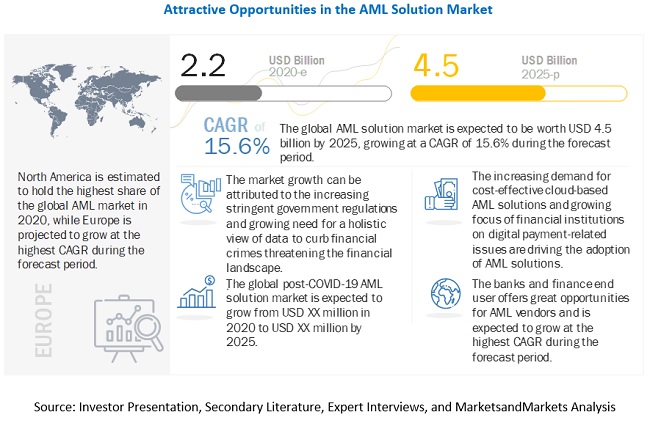

Anti Money Laundering Market Size Share And Global Market Forecast To 2025 Marketsandmarkets

What Is The Difference Between Kyc And Aml Cdd Edd Justcoded

Know Your Customer And Anti Money Laundering Measures Ing

Kyc Aml As New Regulatory Standards In Icos By Geneos Official Geneos Medium

Aml Compliance Checklist Best Practices For Anti Money Laundering

What Is The Difference Between Aml And Kyc Vskills Blog

Anti Money Laundering What Is Aml Compliance And Why Is It Important

Dentons Using Blockchain For Kyc Aml Compliance

Kyc Vs Aml What Is The Difference

Eu 5th Anti Money Laundering Directives By Argos Medium

What Is Know Your Customer Kyc Anti Money Laundering Aml Master The Crypto

Post a Comment for "Kyc Anti Money Laundering Law"