Definition Of Anti Money Laundering Act

It is hereby. Changes authorised by subpart 2 of Part 2 of the Legislation Act 2012 have been made in this official reprint.

Tanzania Financial Intelligence Unit Money Laundering Definition Kitengo Cha Kudhibiti Fedha Haramu Maana Ya Biashara Ya Fedha Haramu

GwG German Anti-Money Laundering Act Act on the detection of proceeds from serious crimes Part 1 Definitions and obliged entities Section 1 GwG Definitions Section 2 GwG Obliged entities power to issue statutory instruments.

Definition of anti money laundering act. Define Anti-Money Laundering Act. Means The Proceeds of Crime Money Laundering and Terrorist Financing Act Canada and the regulations made thereunder as amended from time to time. Typically it involves three steps.

11521 to the AMLA are underlined below for ease of reference Spotlight on New Provisions. This Act shall be known as the Anti-Money Laundering Act of 2001 SEC. The risk shall be assessed in view of inter alia the purpose of the customer relationship the amount of customer funds.

FINRA reviews a firms compliance with AML rules under FINRA Rule. Section 1 Definitions 1 For the purposes of this Act money laundering is an offence under section 261 of the Criminal Code Strafgesetzbuch. First the illegitimate funds are furtively introduced into.

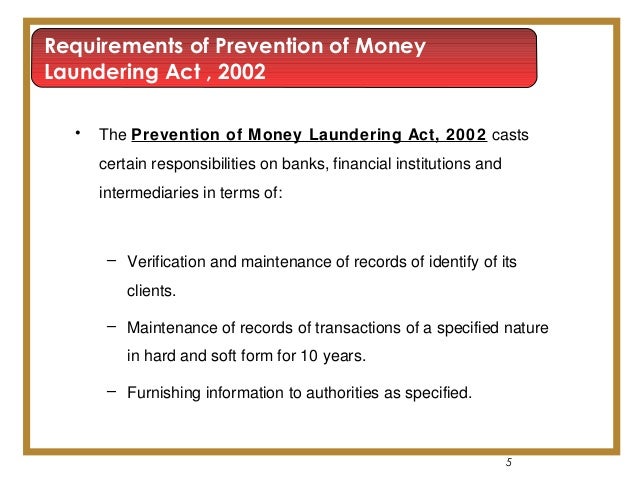

AML laws require that financial instutions report any financial crime they detect to relevant regulators. 3 It shall come into force at once 2. 169 of 2006 as amended taking into account amendments up to Office of National Intelligence Consequential and Transitional Provisions Act 2018.

An Act to provide for the offence of money laundering the measures to be taken for the prevention of money laundering and terrorism financing offences and to provide for the forfeiture of property involved in or derived from money laundering and terrorism financing offences as well as. The Act draws from several prior legislative. 2 It extends to the whole of Pakistan.

By its very nature money laundering is an illegal activity carried out by criminals which occurs outside of the normal range of economic and financial statistics. Ii AMLCFT regulatory authority means the regulator or SRB as defined under section 6A of. The Anti-Money Laundering Act 2010.

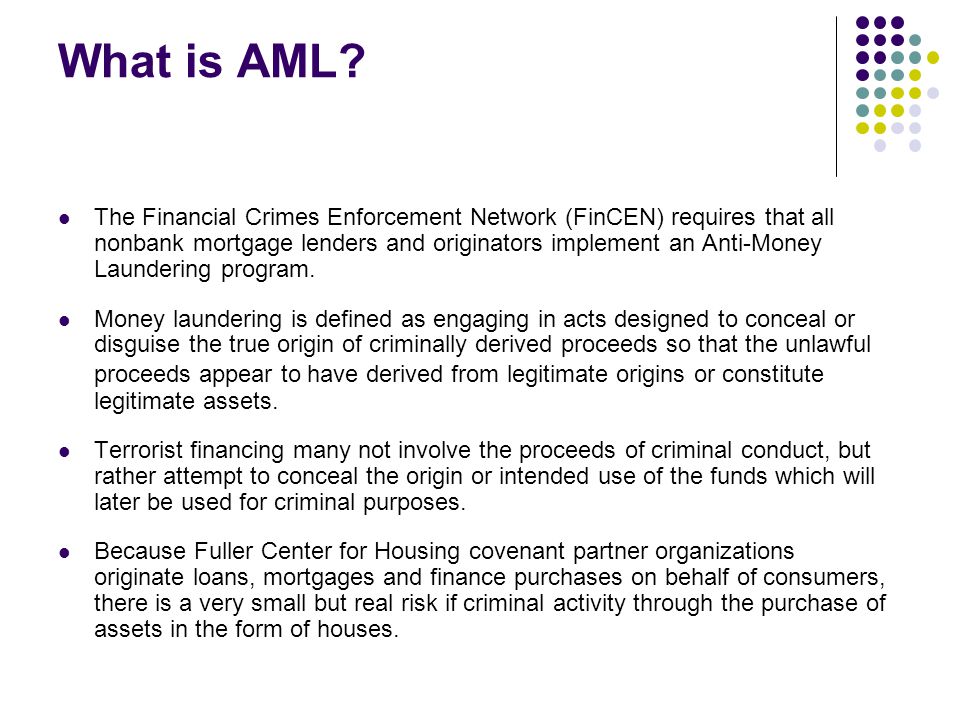

Placement layering and integration. Anti-money laundering AML refers to all policies and pieces of legislation that force financial institutions to monitor their clients to prevent money laundering. 115211 which took effect on February 8 2021 or immediately after its publication in the Official Gazette.

The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. The Anti-Money Laundering Act AMLA has been further amended by Republic Act No. The BSA enacted in 1970 requires financial institutions to assist the federal government in detecting and preventing money laundering and terrorism financing by meeting special program.

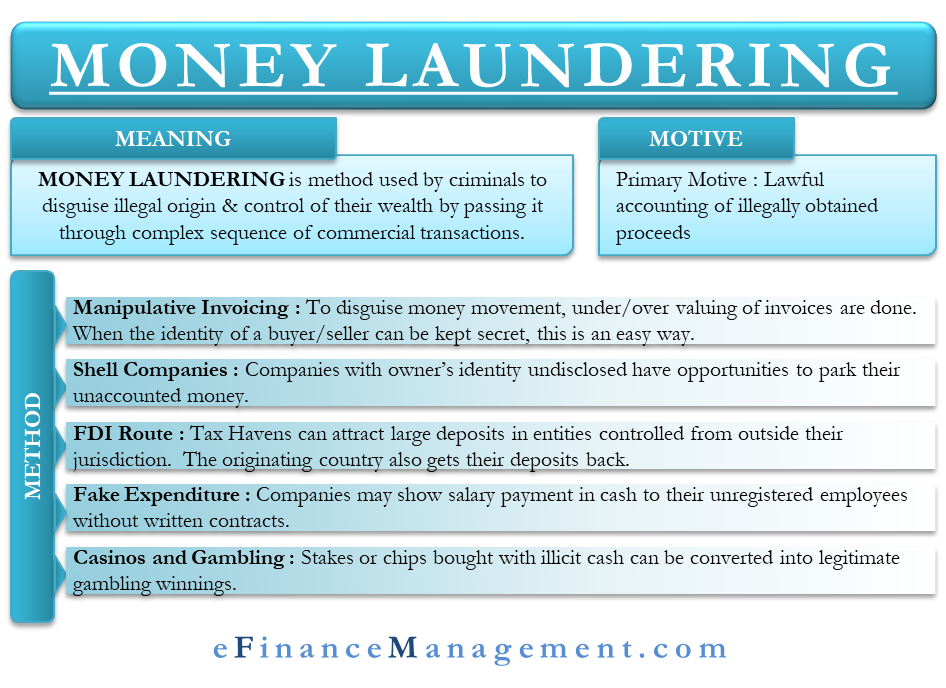

1Definitions In this Act unless there is anything repugnant in the subject or context i AMLCFT means Anti Money Laundering and Countering Financing of Terrorism. The new provisions introduced by RA. History of Anti-Money Laundering Laws Money laundering is the process of making illegally-gained proceeds ie.

This Act is administered by the Ministry of Justice. Objective of Anti-Money Laundering. Anti-Money Laundering and Countering Financing of Terrorism Act 2009.

The NDAA includes the Anti-Money Laundering Act of 2020 the AML Act which in turn contains significant changes to the Bank Secrecy Act BSA and other anti-money laundering AML laws. The Anti-Money Laundering Act. AN ACT DEFINING THE CRIME OF MONEY LAUNDERING PROVIDING PENALTIES THEREFOR AND FOR OTHER PURPOSES.

Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules. An Act to combat money laundering and the financing of terrorism and for other purposes. 1 Obliged entities shall apply customer due diligence measures pursuant to Sections 10 to 20 and conduct ongoing monitoring pursuant to Section 24 on the basis of an assessment of the risk of money laundering and terrorist financing.

Anti-Money Laundering Act of 2020 December 17 2020 The Act represents the culmination of multi-year efforts to reform the BSA regime by addressing longstanding concerns voiced by the private and public sectors. Note 4 at the end of this reprint provides a list of the amendments incorporated. Dirty money appear legal ie.

Along with some other aspects of underground economic activity rough estimates have been. Be it enacted by the Senate and the House of Representatives of the Philippines in Congress assembled.

What Is Anti Money Laundering Quora

What Is Money Laundering And How Is It Done

Anti Money Laundering Overview Process And History

Finra S List Of Aml Red Flags Has Gone From 25 To 97 Regtech Consulting Llc

Key Component Of Aml Anti Money Laundering Compliance Program Plianced Inc

Insurance Anti Money Laundering

Basics Of Anti Money Laundering A Really Quick Primer Money Laundering Money Advice Computer Basics

Anti Money Laundering And Counter Terrorism Financing Law And Policy Showcasing Australia Brill

Anti Money Laundering What It Is And Why It Matters Sas

What Is Aml Kyc In Crypto Sygna

Anti Money Laundering Counter Financing Of Terrorism Aml Cft Ppt Download

Insurance Anti Money Laundering

Anti Money Laundering Aml Ppt Video Online Download

Understanding Money Laundering European Institute Of Management And Finance

Anti Money Laundering What Is Aml Compliance And Why Is It Important

Difference Between Kyc And Aml Tookitaki Tookitaki

Money Laundering Define Motive Methods Danger Magnitude Control

Post a Comment for "Definition Of Anti Money Laundering Act"