Define The Following Money Laundering

Placement is the depositing of funds in financial institutions or the conversion of cash into negotiable instruments. This led to an emphasis on new set of rules to combat money laundering.

India passed Prevention of Money Laundering Act in 2002.

Define the following money laundering. Money laundering is done on a world scale. Something you unfortunately cannot learn to do by looking it up in a dictionary. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income.

Authorities plan to limit cash deposits of dollars at bank counters as a measure against money laundering. Money laundering is the illegal process of covering up the origins of money acquired through criminal activity. The opening of a bank account.

Strategies to avoid detection or maintain plausible deniability. A new report Follow the Money describes the complex web of money laundering money mules front companies and cryptocurrencies that criminals use to siphon funds from the financial system after a large-scale cyberattack. None of the above responses are correct.

The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. In the following sections well take a broad look at the concept and practice of money laundering. Placement is the most difficult step.

Along with some other aspects of underground economic activity rough estimates have been. Define the following term money laundering. If youve come here to just turn yourself over to the police and tell them where you got all the money.

It required financial institutions to increase surveillance and monitoring of financial transactions. Typically a money launder will cover up the funds origin by passing it through various banks and legitimate businesses. Create your account to access this entire.

Money laundering works by transferring money in elaborate and complicated financial transactions which mislead anyone who. Why people and organizations launder money. Until they do this they are unable to use the money without authorities tracing it back to their crime.

An elaborate and convoluted scheme to hide money. Simply put money laundering is a common technique used by financial criminals and others to hide illegal gains. By its very nature money laundering is an illegal activity carried out by criminals which occurs outside of the normal range of economic and financial statistics.

Money laundering usually consists of three steps. The action of moving money which has been earned illegally through banks and other business to make it seem to have been earned legally. Money laundering is the illegal process of converting money earned from illegal activities into clean money that is money that can be freely used in legitimate business operations and does not have to be concealed from the authorities.

Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct. The report by SWIFT and BAE Systems recently highlights the ingenuity of money laundering tactics to obtain liquid financial assets and avoid any subsequent. How money laundering works.

Today AML KYC regulations have become a much larger. The Group of Seven G7 countries used Financial Action Task Force FATF to put pressure on governments. Money laundering is the term used to describe the act of taking illegal money from source A and making it look like it came from source B a legitimate legal source.

Money laundering is a way to conceal illegally obtained funds. What it is and how it works. Money laundering investigations have busted kingpins of international criminal organizations prevented terrorists from carrying out attacks exposed double agent spies and even contributed to the resignation of a United States president.

Criminals make the proceeds of crime appear to be legitimate in order to get away with their crime without raising suspicion. What is money laundering. A simple plan to hide money.

Money Laundering meaning in law Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct. Placement layering and integration. When you wash your pants and there is still money inside them.

Broadly defined money laundering is the act of disguising the proceeds of illicit activities.

6amld 22 Predicate Offenses For Money Laundering Complyadvantage

Cryptocurrency Money Laundering Explained Bitquery

Money Laundering Awareness Objectives L Define Money Laundering

What Is Money Laundering And How Is It Done

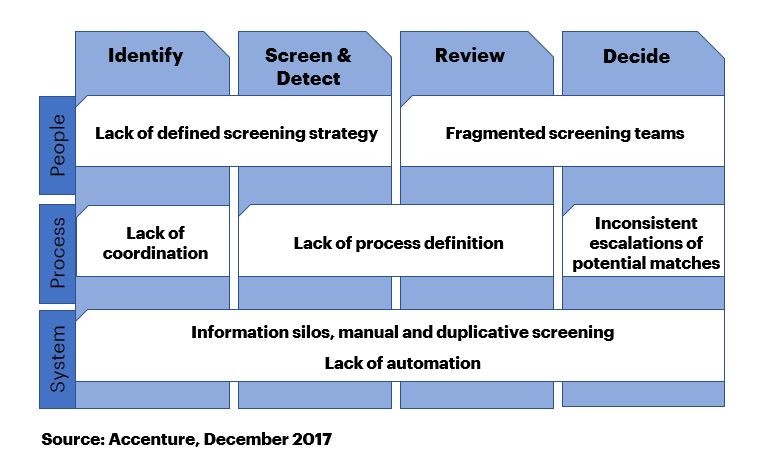

Anti Money Laundering Know Your Customer Adverse Media Screening And The Data Challenge Accenture

Understanding The Risks Of Money Laundering In Sri Lanka The Lakshman Kadirgamar Institute

Tanzania Financial Intelligence Unit Money Laundering Definition Kitengo Cha Kudhibiti Fedha Haramu Maana Ya Biashara Ya Fedha Haramu

Money Laundering Define Motive Methods Danger Magnitude Control

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

What Is Aml Kyc In Crypto Sygna

Money Laundering Awareness Objectives L Define Money Laundering

Anti Money Laundering Overview Process And History

What Is Anti Money Laundering Aml Anti Money Laundering

Pdf Implementing A Sustainable Model For Anti Money Laundering In The United Nations Development Goals

Money Laundering And Terrorism Financing Prevention Manual

4 Differences Between Money Laundering And Terrorist Financing

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

Qatar In Imf Staff Country Reports Volume 2008 Issue 322 2008

Post a Comment for "Define The Following Money Laundering"