Define Customer Money Laundering

There are circumstances where the risk of money laundering or terrorist financing is higher and enhanced CDD measures have to be taken. KYC and AML are acronyms for Know Your Customer and Anti-money Laundering and refer to the set of activities that both financial institutions and regulated businesses must perform to verify the identity of their customers and obtain sensitive information from them as well as prevent money laundering from illegal activities.

Money Laundering Define Motive Methods Danger Magnitude Control

A critical risk to Australia.

Define customer money laundering. Layering Crimes that generate significant financial proceeds such as theft extortion drug trafficking and human trafficking almost always require a money laundering component so that criminals can avoid detection by authorities and use the illegal money that. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income.

At a minimum an anti-money laundering program should include. Money laundering is the act of placing illegal gains into the legitimate financial system in ways that avoid drawing the attention of banks financial institutions or law enforcement agencies writes McCoy in USA Today. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017.

In accordance with Article 41 of the Anti-Money Laundering Law financial institutions should take enhanced due diligence measure when they carry out occasional transactions on behalf of or establish business relationships with politically exposed persons PEPs family members of such persons or persons known to be close associates of such persons. However some respondents also highlighted that. Money laundering is one of the three critical organised crime risks to the Australian community identified in the classified 2010 Organised crime threat assessment and articulated in the unclassified and published Organised crime in Australia 2011Both of these reports were developed by the Australian Crime Commission the Commonwealth agency established to combat.

Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. A change in vocation or promotion at work for a customer could affect their money laundering risk for example if the customer became a PEP. When assessing the money laundering and terrorist financing risks relating to types of customers countries or geographic areas and particular.

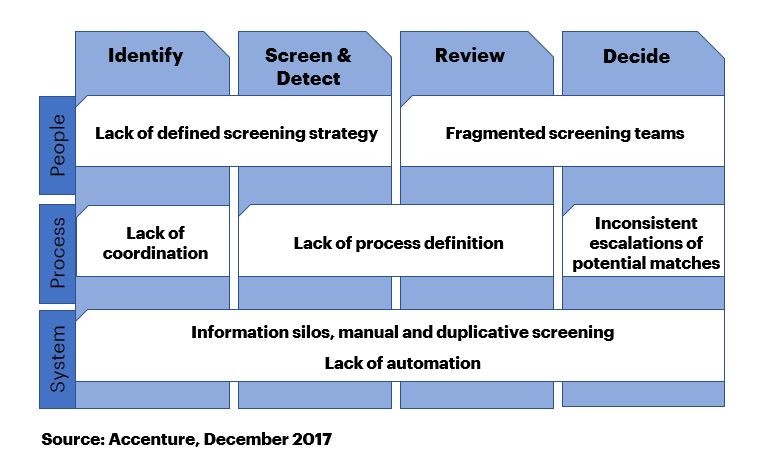

Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in. This legislation built on the 2007 regulations although there are some specific and potentially significant changes that you need to be aware of and factor into.

Cryptocurrency Money Laundering Explained Bitquery

Voluntary Good Practices Guidance For Lawyers To Detect And Combat Money Laundering And Terrorist Financing Resources The American College Of Trust And Estate Counsel

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

Anti Money Laundering Know Your Customer Adverse Media Screening And The Data Challenge Accenture

Understanding The Risks Of Money Laundering In Sri Lanka The Lakshman Kadirgamar Institute

Eu Policy On High Risk Third Countries European Commission

Malaysia What Is Money Laundering Conventus Law

Finalization Of The 4th Anti Money Laundering Directive Bankinghub

What Is Money Laundering And How Is It Done

4 Differences Between Money Laundering And Terrorist Financing

What Is Aml Kyc In Crypto Sygna

Anti Money Laundering Overview Process And History

Tanzania Financial Intelligence Unit Money Laundering Definition Kitengo Cha Kudhibiti Fedha Haramu Maana Ya Biashara Ya Fedha Haramu

Anti Money Laundering Counter Financing Of Terrorism Aml Cft Ppt Download

How To Achieve Compliance In An Ever Changing World

Anti Money Laundering Aml Ranks As One Of The Top Priorities Of Banks Worldwide Regulatory Age Evaluation Employee Money Laundering Employee Evaluation Form

Post a Comment for "Define Customer Money Laundering"